Risk Analysis of XBB and VXC ETF

CAN Financial Fast Track - Mini Presentation by Brian Chu 2024 DEC

Dec 2024

Dec 2024

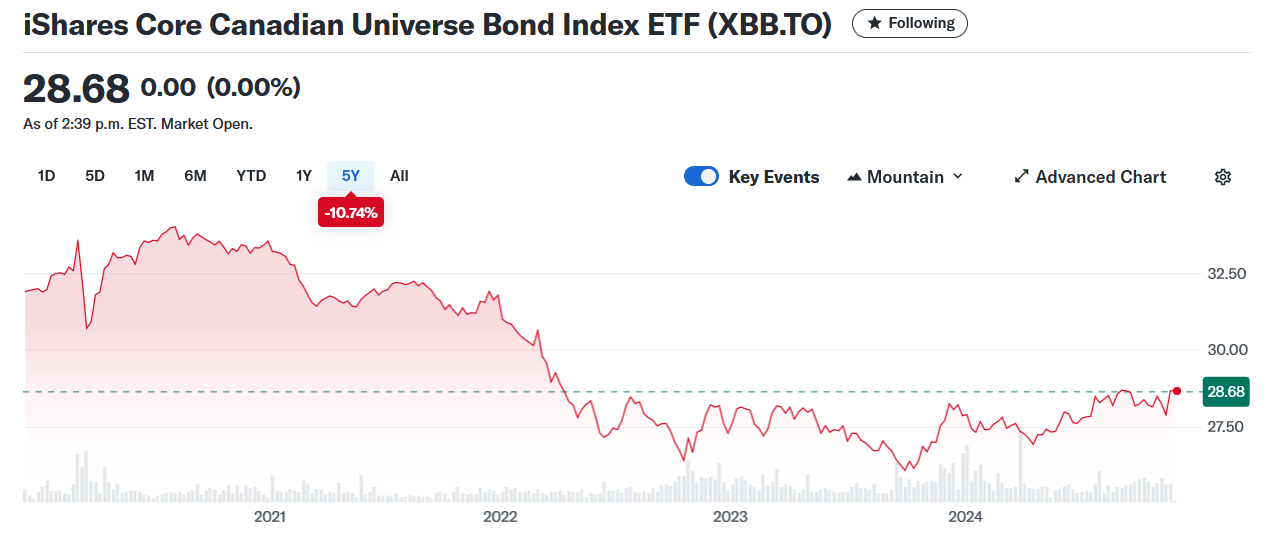

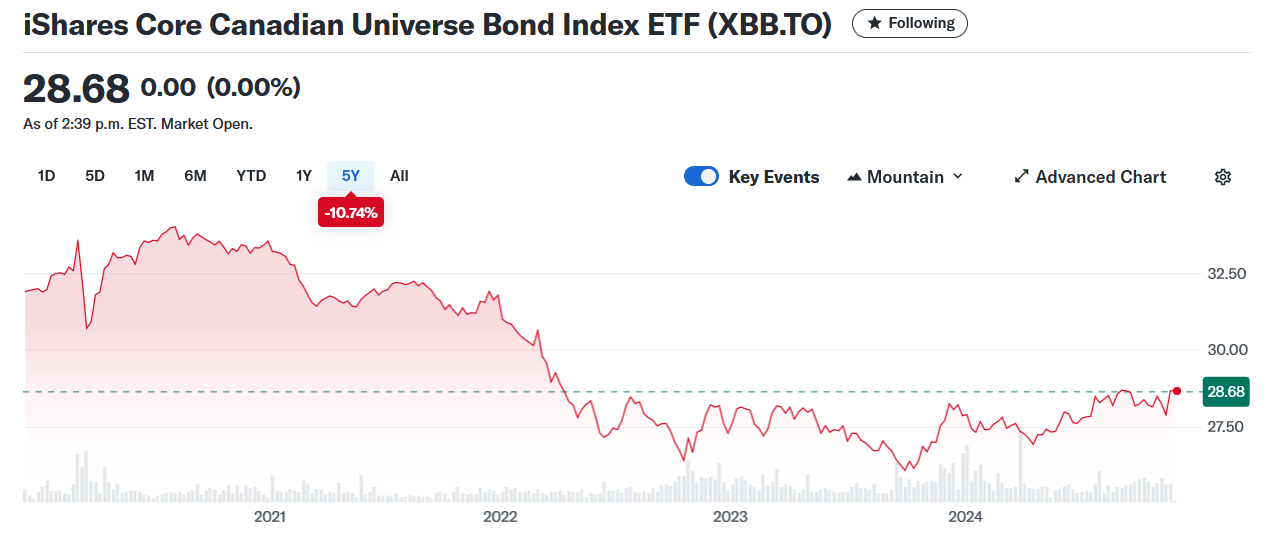

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| 0.32 | 0.1 | -0.07 | |

| BETA | 1.05 | 1.02 | 1 |

| Mean Annual Return | 0.01 | 0.05 | 0.17 |

| 99.37 | 98.92 | 98.93 | |

| Standard Deviation | 7.39 | 6.56 | 5.41 |

| Sharpe Ratio | -0.47 | -0.26 | 0.09 |

| Treynor Ratio | -3.55 | -1.9 | 0.33 |

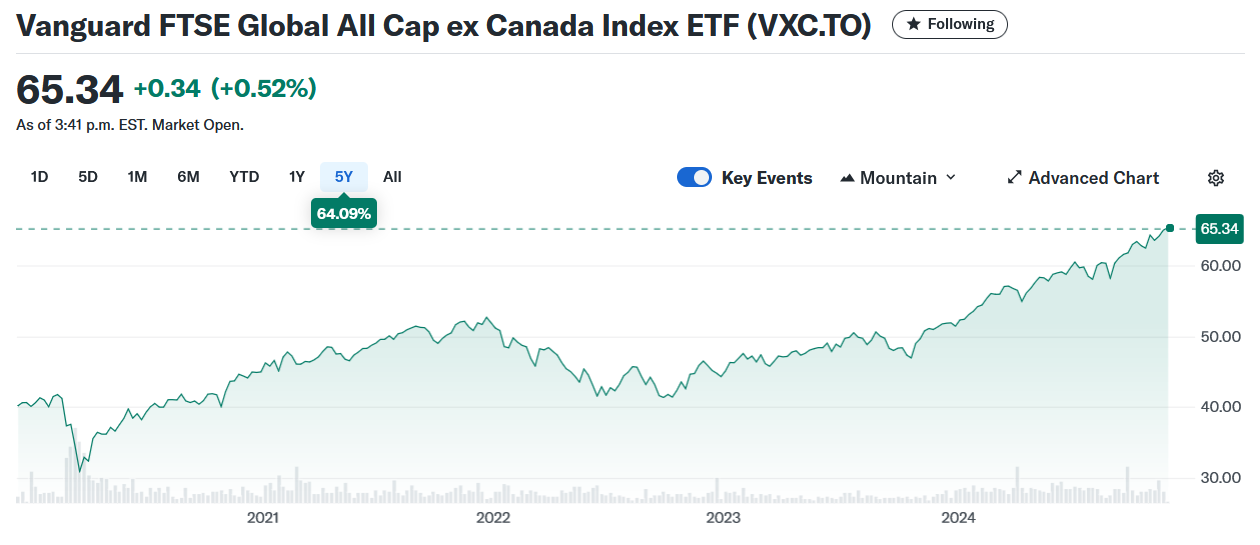

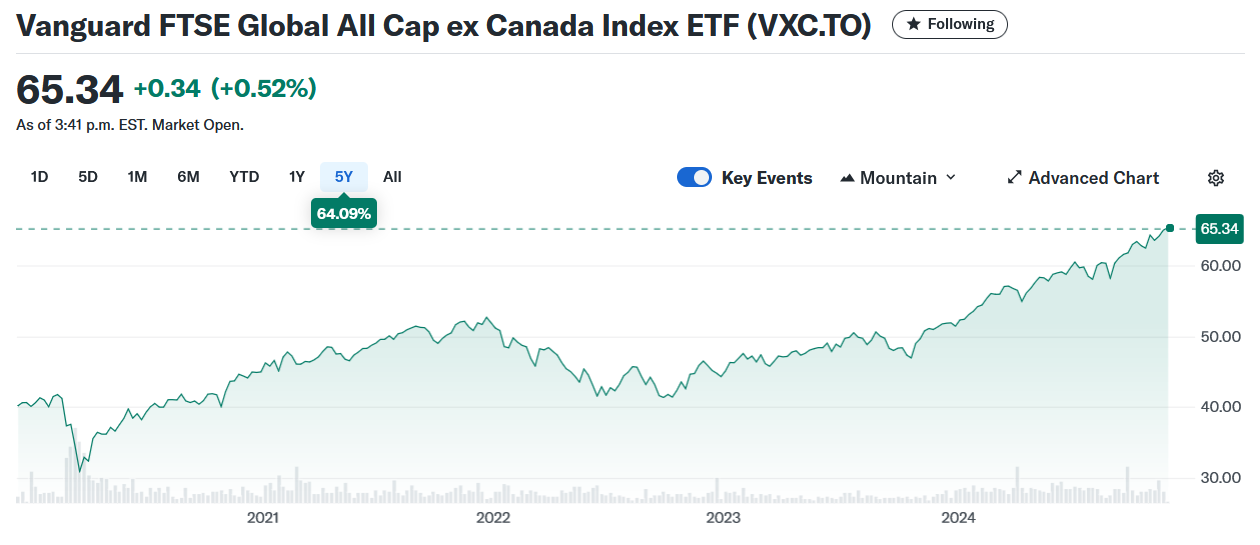

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Alpha | -0.55 | -0.6 | -0.84 |

| BETA | 0.99 | 1.01 | 1.02 |

| Mean Annual Return | 0.79 | 1.01 | 0.94 |

| R-squared | 99.59 | 99.2 | 98.78 |

| Standard Deviation | 12.4 | 13.21 | 12.01 |

| Sharpe Ratio | 0.48 | 0.75 | 0.8 |

| Treynor Ratio | 5.54 | 9.5 | 9.2 |