Sarah, born July 1, 1991, and Romeo, born May 20, 1988, met while Romeo was completing school in Calgary. They got married and had two children: Charlotte, born June 30, 2015, and Oliver, born October 9, 2017. They have been married for 10 years and enjoy an active life style. Romeo’s family is mostly in Greece, but Sarah’s family is local.

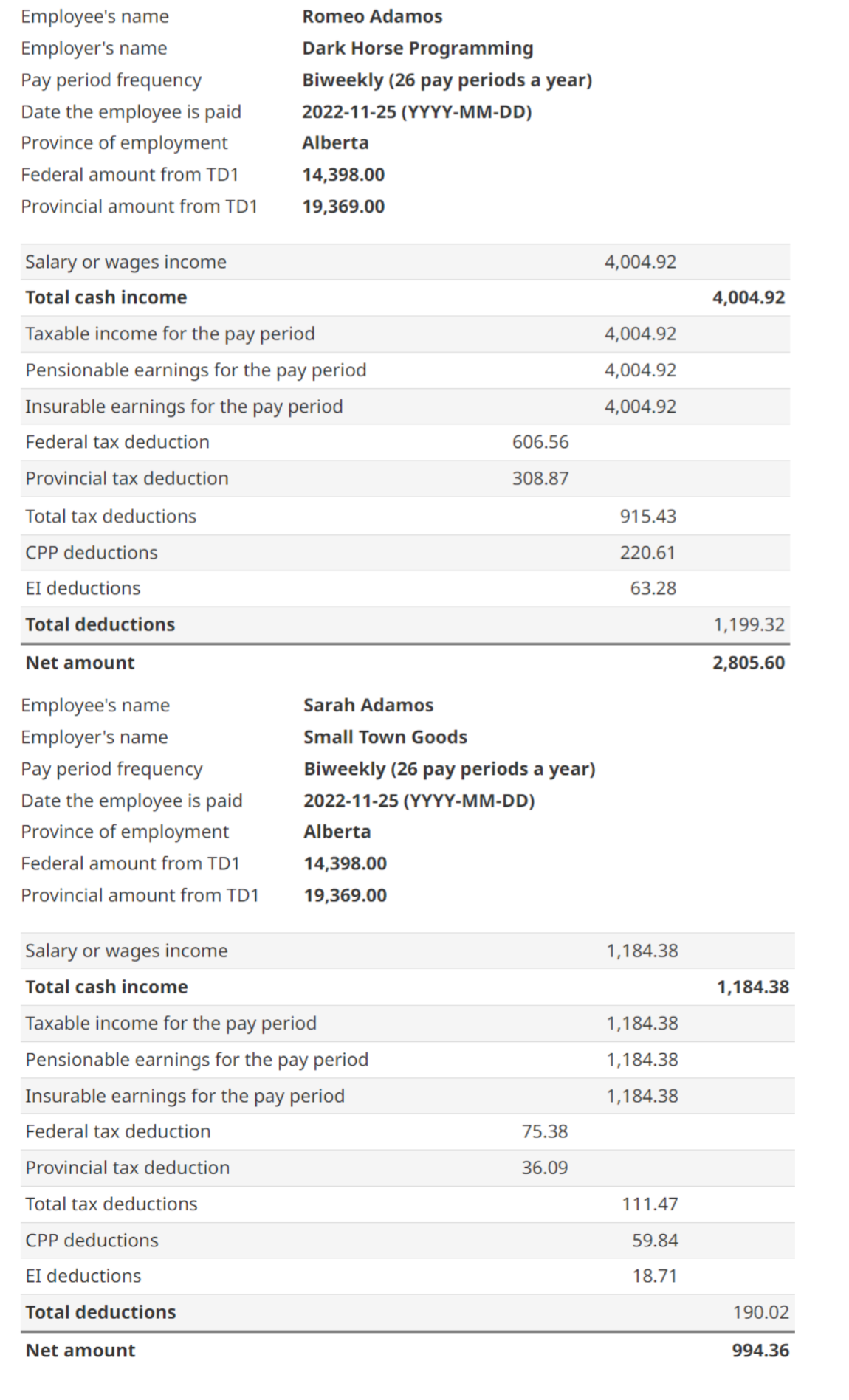

Romeo is a computer programmer with 10 years experience. He currently works with Dark Horse Programming and earns $104,128.00 annually plus a bonus and benefits. He is paid biweekly and contributes $130 per pay cheque to a pension plan. His pension plan is currently worth $37,180.00. In addition, Romeo has a TFSA with a balance of $22,345.00. Romeo’s states he has a moderate risk profile, but likes knowing his investments are secure. He understands that he has a long investment time frame and knows minimal losses will be regained over time. He enjoys learning and is currently completing a stock trading course through Coursera. Romeo’s family is in great health. They tend to die of health issues associated with old age as they pass away in their 90’s. Although generally healthy, Romeo has type 1 diabetes that is well managed with diet, exercise, and medication. Romeo does not smoke, but enjoys a glass of wine with dinner every night. He is an avid skier, scuba diver, and traveller. He travels to Greece to visit his family at least twice per year. Romeo has a credit score of 750 with no missed payments, collections, consumer proposals, or bankruptcies in the last 7 years showing. Romeo has benefits through his work that covers 80% of most medical expenses, including prescriptions, dental, and paramedical. He does not have optical coverage, but has 20-20 vision. This is a family plan and costs $225/pay period. His work has a minor life insurance policy that provides wages after taxes and other deductions for one year after the employee’s date of passing. He has no other life insurance for himself or his family. Romeo has a class 5 GDL license. He has only had his license for five years and has had one car accident. He has “the need for speed” and has gotten three speeding tickets in the past year. He hasn’t had insurance on his car cancelled in the past five years.

Sarah recently re-entered the workforce since Oliver started school. She works part time as a key holder at Small Town Goods and expects to earn $30,794.00 per year. She is paid biweekly. Because she is part time, she does not have benefits and has not enrolled in the company retirement plan. Romeo has set up a spousal RRSP for Sarah which has a balance of $8,904.00. Sarah is risk averse and does not like to take chances with her money. Sarah’s sister, Anna, is a single mom, that is currently battling stage four cancer. Sarah spends a lot of time helping Anna. Anna’s son, Roger (10), spends a lot of time with Sarah and Romeo. It is not expected that Anna will survive more than a year. Sarah and Romeo have agreed to take care of Roger when Anna passes. Cancer runs in Sarah’s family as she lost her mother and grandfather to cancer. Sarah is a smoker, but does not drink. She has asthma and has been trying to quit smoking to better her life. She currently smokes two cigarettes per day on average. She enjoys crafting, playing music, and has competed internationally in ballroom dancing. Much like Romeo, she is an avid traveller and enjoys volunteering in developing countries to provide housing, education, and health care to children. Most recently, she volunteered in Kenya to help vaccinate children against malaria. Sarah’s has a credit score of 698. Three years ago, she had one missed payment in the 31-60 day category due to her online banking being down and being unable to process a payment. There are no other recorded credit damages. Sarah does not have any benefits through work. Her dad has a life insurance policy for $50,000.00 with him listed as the beneficiaries. He states the money to fund the children’s college education should Sarah pass. Sarah has a class 5 non-GDL driver’s license with no driving infractions or demerits. She prides herself on being a safe driver and has never gotten in an accident or had a speeding fine. She has never had her auto insurance cancelled.

Sarah and Romeo are currently renting a three bedroom home in Red Deer. They have been saving to purchase a house in Romeo’s TFSA and would like to buy at least a four bedroom house under the expectation that Roger will live with them. Sarah owns a 2014 Dodge Dart limited, 4 door, worth $10,787.00 and pays $190/month in insurance. Romeo has a car loan for a 2018 Subaru Crosstrek worth $35,617.00 and pays $140/month in insurance. He pays an additional $307.75 biweekly for his car loan and has 3 years left. There is a balance of $23,850.98 remaining on the car loan. Their car insurance has a deductible of $500, but does not cover glass breakage or damage. They pay $45/month for tenant insurance that covers contents and property liability. Their deductible is $750 for any claims. Their kids enjoy many activities. Charlotte is in dance which costs $235 per month and runs 10 months of the year. Oliver enjoys Sport Ball which costs $200 per month and runs for 6 months of the year. Both children attend swimming and piano lessons that cost $300 per month which runs all year round. The children often join Romeo on trips to Greece, but rarely go with Sarah on her humanity projects. When the children are in high school, Romeo and Sarah have agreed to let them join Sarah on her volunteer trips. Romeo has a personal loan with a balance of $24,000 and pays $320.00 biweekly with an interest rate of 4.54% financed over 36 months. They have a joint credit card with a maximum of $7,500 and a balance of $3,256.74. The credit card charges 22.75% interest with a $120 annual fee. Sarah has a personal credit card with a maximum of $3,200, a balance of $2,284.23, an interest rate of 19.35%, and an annual fee of $90.

| Bill | Amount | Frequency |

|---|---|---|

| Rent | $1600.00 | Monthly |

| Water & Garbage | $250 | Monthly |

| Internet, TV, & Phone | $225.00 | Monthly |

| Power | $152.00 | Average, Monthly |

| Gas | $152.00 | Average, Monthly |

| Home Insurance | $104 | Monthly |

| Groceries | $850.00 | Average, Monthly |

| Dining Out | $300.00 | Average, Monthly |

| Medical Expenses | $75.00 | Monthly |

| Clothing | $150.00 | Average, Monthly |

| TFSA Contribution | $150.00 | Biweekly |

| Spousal RRSP | $200.00 | Biweekly |